Navigating Tax Season with ChatGPT: Your AI Tax Assistant

AI and Taxes: A Match Made in Digital Heaven

The tax season often brings a mix of confusion and stress, but what if you had a smart AI assistant like ChatGPT to ease the burden? With the continuous evolution of AI, ChatGPT is becoming an increasingly helpful tool for tax practitioners and individuals alike. Let's explore how this AI can assist you during tax season.

Understanding ChatGPT's Role in Tax Assistance

ChatGPT, developed by OpenAI, is a language model that can comprehend and respond to a variety of queries, including those related to taxes. Think of it as a highly knowledgeable companion that you can consult for tax-related information and guidance.

Practical Steps for Utilizing ChatGPT in Tax Preparation

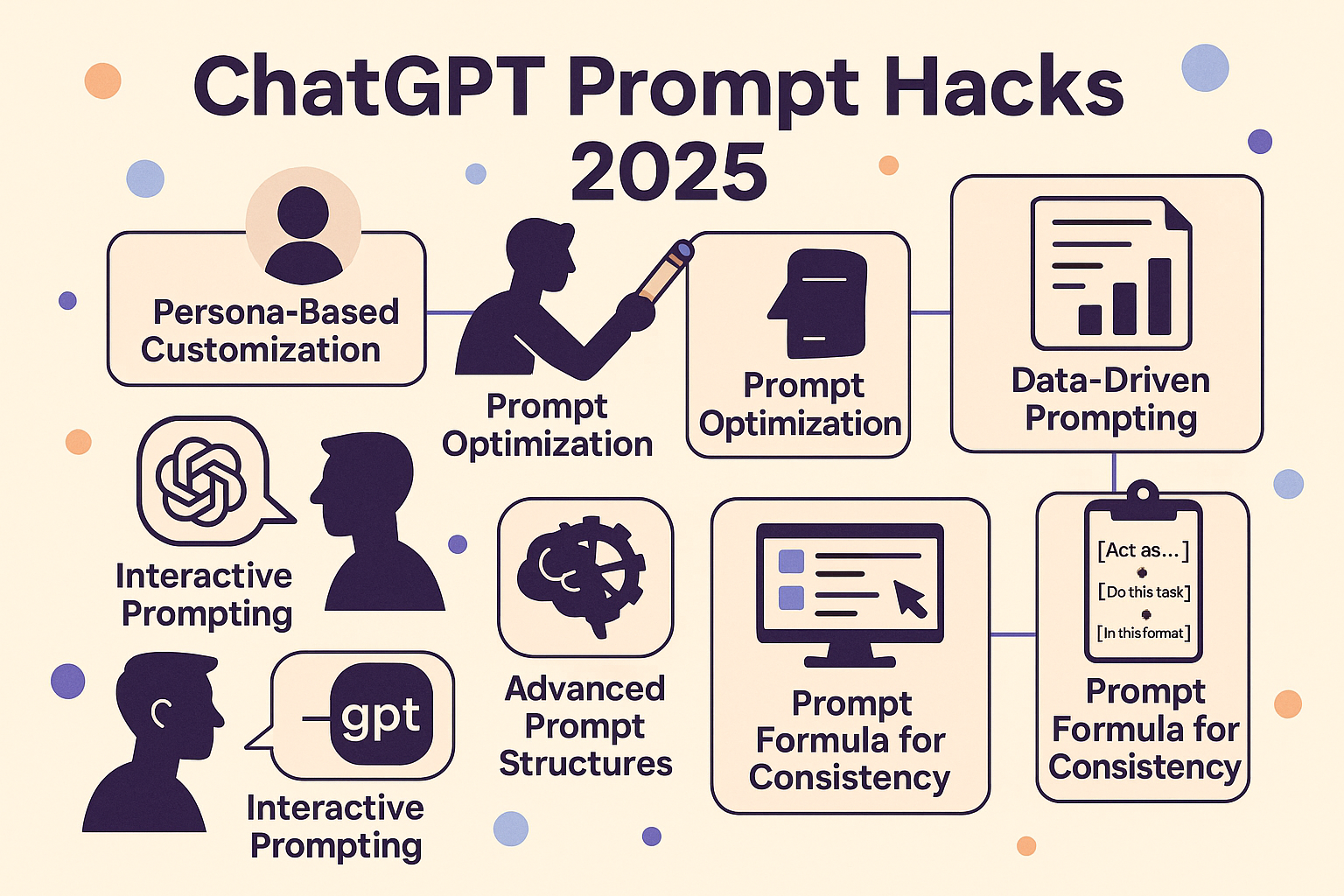

To effectively use ChatGPT for tax assistance, follow these steps:

- Define Your Objective: Clearly articulate what you need from ChatGPT, whether it's understanding tax implications or seeking specific advice.

- Craft Clear Prompts: Provide detailed questions or instructions to get accurate and relevant responses from ChatGPT.

- Evaluate the Responses: Check the AI's responses for reliability and accuracy, comparing them with your existing knowledge or additional resources.

- Iterate for Customized Output: Refine your prompts and try different approaches to extract the most useful information from ChatGPT.

A Practical Example

Imagine a tax practitioner needing advice on the tax implications of a client’s investment property sale. By inputting specific queries into ChatGPT, the practitioner can receive a range of relevant suggestions and references to applicable tax codes, such as capital gains tax, depreciation recapture, and net investment income tax.

The Balance Between AI Assistance and Professional Expertise

While ChatGPT can offer valuable insights and suggestions, it's crucial to use professional judgment in interpreting and applying this information. ChatGPT should be viewed as a supplementary tool, not a replacement for professional tax advice.

Conclusion

ChatGPT can be a valuable asset during tax season, providing quick access to tax information and guidance. However, its use should be complemented by professional knowledge and expertise.

Disclaimer:

This article is intended for informational purposes only and does not constitute professional tax advice. While every effort has been made to ensure the accuracy and reliability of the information provided, the application and impact of laws can vary widely based on the specific facts involved. The information in this article may not be applicable to all situations and is not a substitute for the advice of a qualified professional. We recommend consulting with a certified tax advisor or accountant for advice on your specific tax situation. OpenAI, the creator of ChatGPT, is not a licensed tax advisor. Users should exercise caution and independently verify any information obtained from ChatGPT before making any tax-related decisions. The use of ChatGPT in tax preparation and consulting should complement, not replace, professional judgment and expertise.